Tax Tip Thursdays with The Mad Accountant on 105.5 HITS FM

We are on the radio every Thursday morning at 8:10, with Morning Den host Dan Pollard, giving YOU our latest tax tips. You can listen to highlights and full episodes below, and even engage in discussion with us using the blog posts at the bottom of the page. Hear something you like? Please don’t hesitate to give us a call.

We are on the radio every Thursday morning at 8:10, with Morning Den host Dan Pollard, giving YOU our latest tax tips. You can listen to highlights and full episodes below, and even engage in discussion with us using the blog posts at the bottom of the page. Hear something you like? Please don’t hesitate to give us a call.

Full Radio Shows

Looking for Something Specific?

Full Episodes & Discussions

TTT: Let’s Talk RRSP!

Make the most of your RRSP contributions!

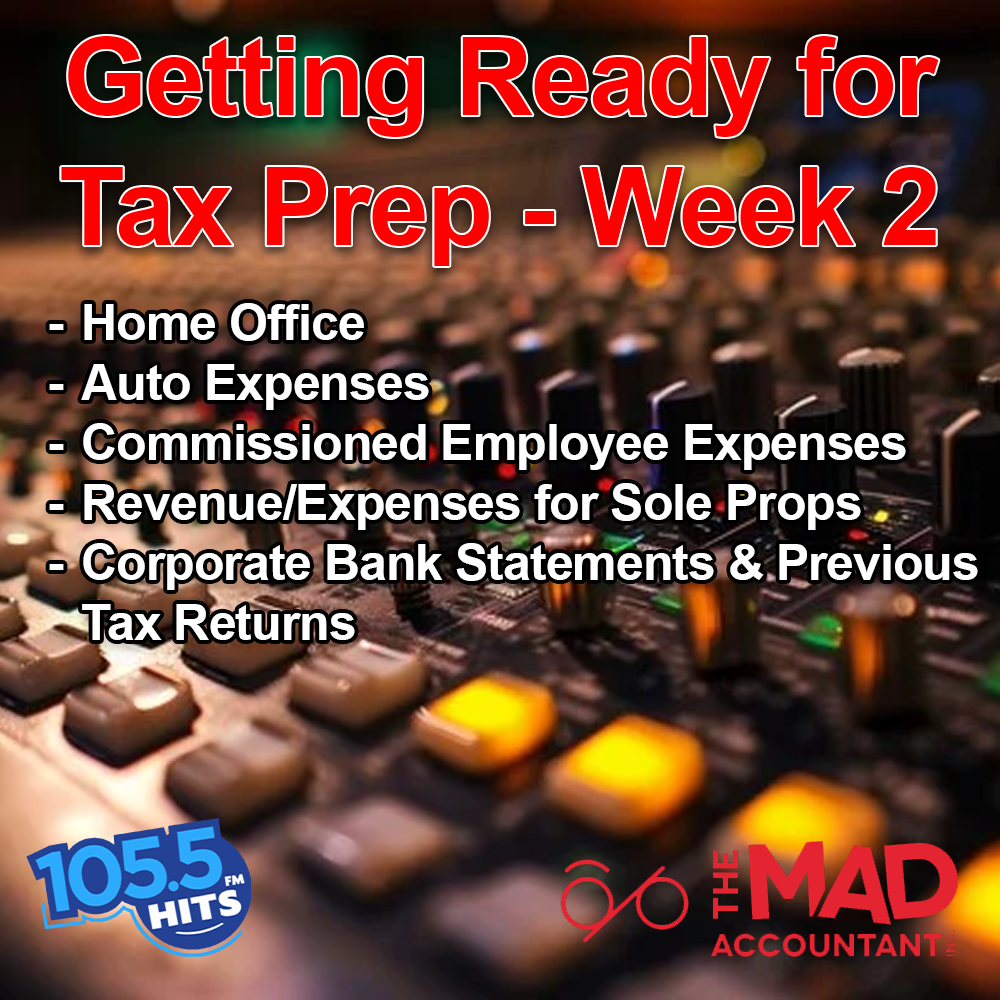

TTT: Getting Ready for Tax Season – Week 2

Be prepared for small business taxes!

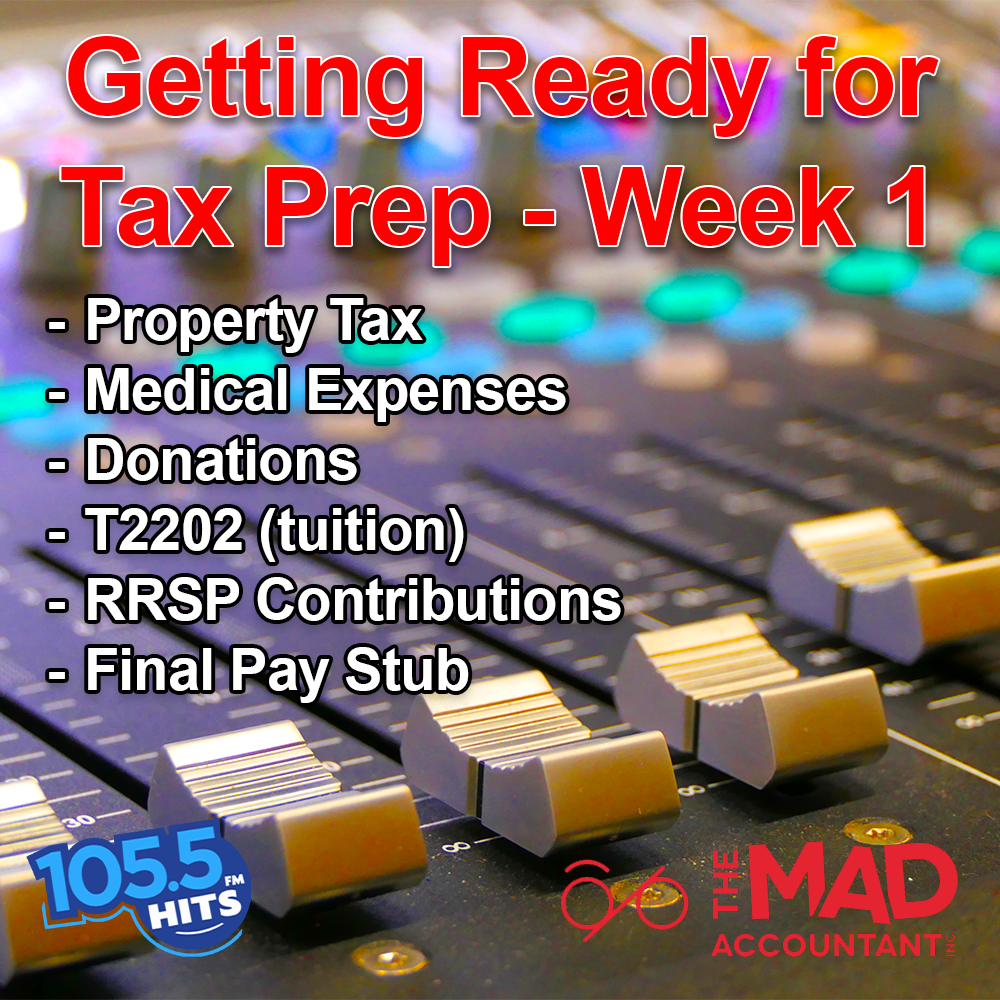

TTT: Getting Ready for Tax Season – Week 1

Always be prepared!

TTT: CRA Changes for 2025

What's new for 2025?

TTT: New Year Financial Planning – Week 2: Know Your Numbers

Knowledge is power - know your numbers!

TTT: New Year Financial Planning – Week 1: Ways to Save

Start the new year off on the right financial foot with these helpful tips!

TTT: Remittances vs. Instalments

Do you know the difference between remittances and instalments? Look no further, we’ve got the answer for you!

TTT: Year End Tax Tips – Week 4: Individuals & Business Owners

From individual charitable donations to compensation planning for corporate business owners, we cover it all here!