User Guide

How to Set Up MyCRA and MyBusiness

This is a pretty easy and straightforward process for the most part.

For initial access for yourself, you have to go to https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html

You have to provide basic tombstone information as well as information from one of your 2 previous years tax returns.

Once you have personal access then you can get Business Access.

The processes for both are very similar, so if you see something that only applies to Business it can be omitted as you do your personal account.

Please make this happen for your own benefit!

How to Set Up Your MyCRA Account

Make sure you set up your personal MyCRA account first! You will need it to open a MyBusiness account.

You will have to complete two steps. Open this site https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html

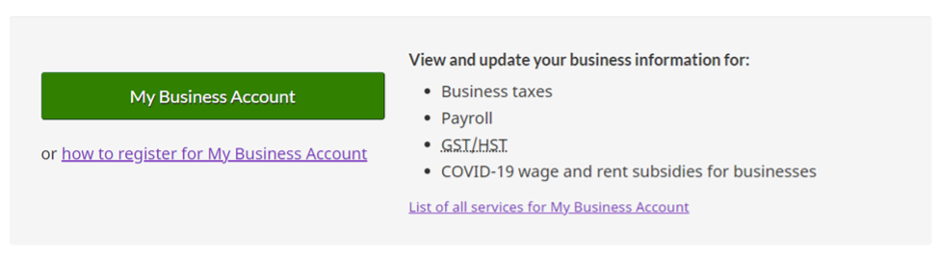

Scroll down to My Business Account, click on it, then scroll down to Option 2 and click on CRA register.

If you want to open a My Account, choose that option instead of My Business Account.

Step 1 – Provide Personal Information

- Enter your social insurance number.

- Enter your date of birth.

- Enter your current postal code.

- If you live outside Canada and the United States, the postal code or ZIP code is not required. The postal code or ZIP code field is not case-sensitive and may or may not include spaces or dashes.

- Enter an amount you entered on one of your income tax and benefit returns.

- Have a copy of your returns handy as you will be asked for a specific line’s amount and the line amount requested will vary; it could be from the current tax year or the previous one. A return for one of these two years must have been filed and assessed to register.

- Create a CRA user ID and password.

- Create your security questions and answers.

- Save or print the list of questions and answers in a secure place that nobody else can access!

- Enroll in mandatory multi-factor authentication by selecting your preferred method (telephone or passcode grid).

- Enter your business number. If you are applying for a personal account, omit this step.

Once you have completed the request, close the browser tab.

The CRA will send your security code via surface mail and it will take 5 to 10 business days to arrive. This is one brown CRA envelope you should open immediately. Once you have it, proceed to Step 2.

Step 2 – Log In and Enter Your Security Code

Navigate to the Canada Revenue Agency (CRA) main page and click on the green button, as shown below:

On the next page, scroll down until you see My Business Account and click on the green button (it will say MyCRA for your personal account):

From here, select Option 2 — Using a CRA User ID and Password.

If you are first prompted to enter your Business Number, go ahead and add it.

Step 3 – Granting Access to Your Accountant

This is one of the most important steps! We cannot help you with your taxes until you do this.

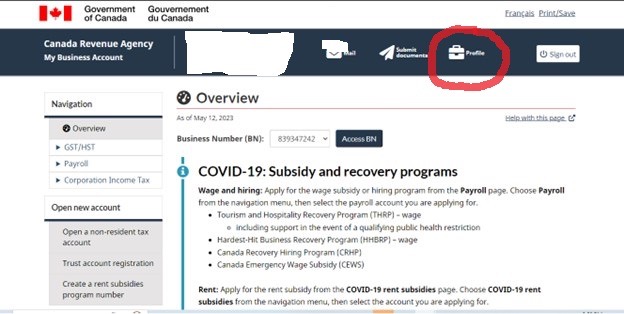

To start, click on the Profile button circled in the image below:

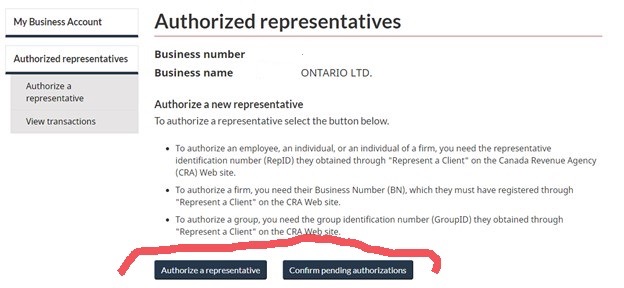

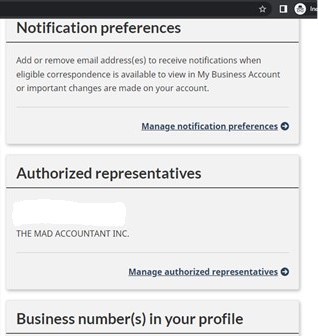

You will see a screen of grey tiles with bold headings, one of which is Authorized Representatives. Click on the link to Manage authorized representatives. You will be shown a screen with a couple of buttons. Click the blue Authorize a representative button as circled in this image:

From here, simply enter The Mad Accountant’s information as follows:

The Mad Accountant Inc.

Group Rep ID#: GZG8MR

Once you’re done, return to your business account and you should see something like this, confirming that we have been added:

Step 4 – Let Us Know!

Once you’ve done all this, please let us know! We can then get started working on your taxes.

Still Having Issues?

Please book an appointment with us and we can help you figure out what might be going wrong. Getting this done right is for both of our benefits!

Disclaimer:

This article provides information of a general nature only. It is only current at the posting date. It is not updated and it may no longer be current. It does not provide legal or tax advice nor can it or should it be relied upon. All tax situations are specific to each individual. If you have specific tax questions you should book an appointment for a 1 on 1 consultation.