Tax Tip Thursday

Tax Tips & Tricks 101

We will take a break from bookkeeping this week and come back to that next week. I have had a lot of questions of late about splitting pensions, so I thought we should talk about that.

Income splitting is a perennial hot topic among retirees, but one aspect of it is often neglected, according to some financial planners: the ability to share Canada Pension Plan payments.

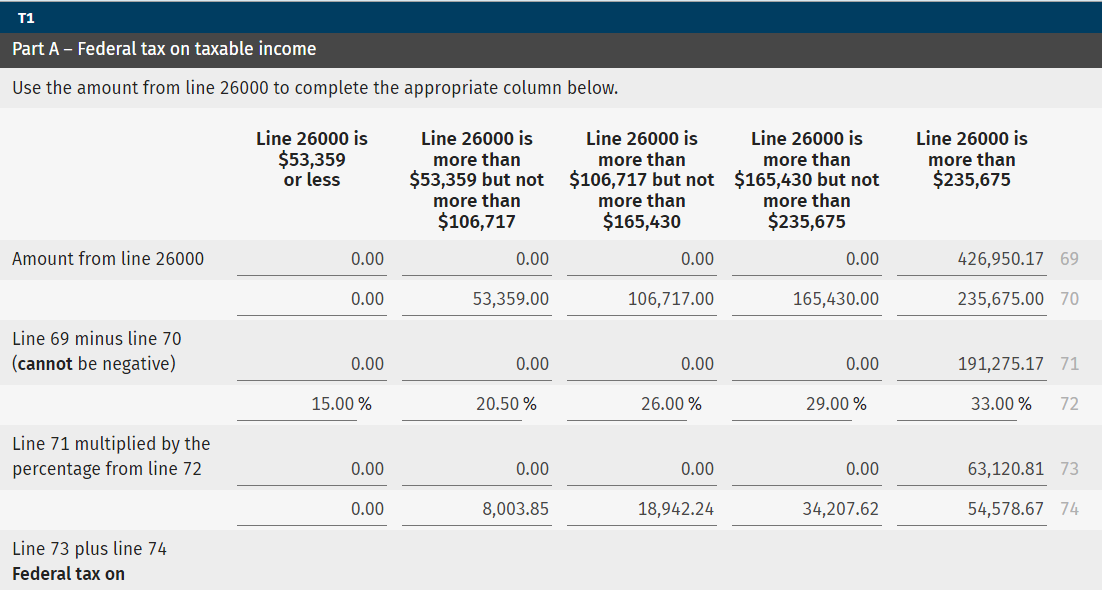

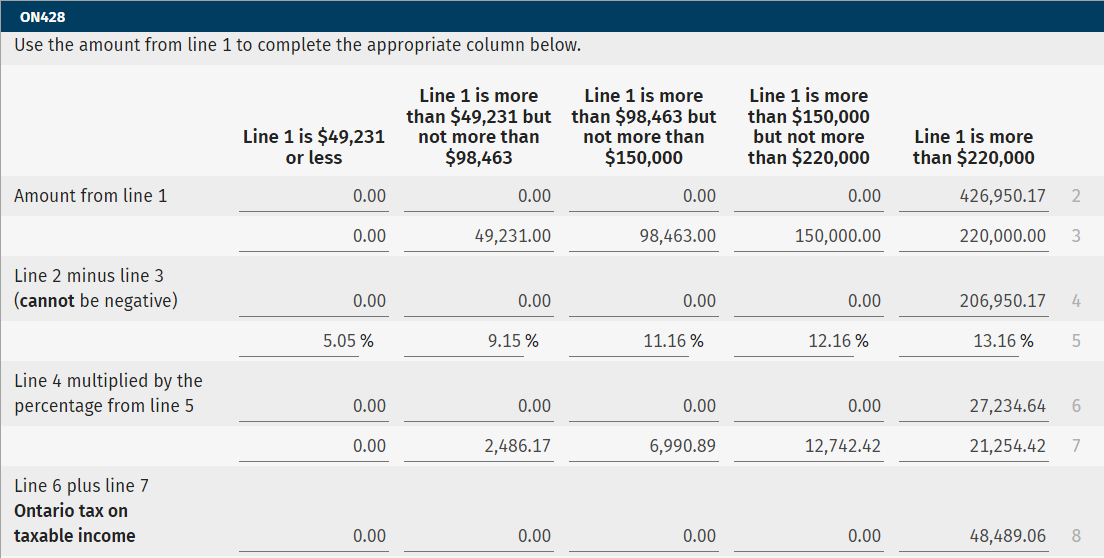

While people are very familiar with the term Income splitting, they do not necessarily understand why and how it works. Because our tax system is progressive, it means that the more we make, the higher the tax rate that is applied to the next dollar that you earn. Following is a chart of the Fed and Provincial tax rates and brackets… see below!

Tax Brackets

Our federal tax brackets are $53k, $106k, $165k, and $235k. Once you beginning making above $106k, you will pay approximately 8% more in tax on each dollar above $106k, then you did below $106k, but your tax remains the same on the income below that threshold.

So if you and your spouse are both in between 2 of those brackets, unless the income splitting can move one of you to a lower bracket (without taking the other person to a higher bracket, then it is worth it to income split, otherwise, not. Income splitting means attributing some of that money to a spouse or common-law partner who is taxed at a lower rate. Doing so can sizably reduce a couple’s overall tax bill. Since Canada introduced income-splitting rules for certain kinds of pension income in 2007, retirees have been taking advantage of the tax perk with gusto. But the focus on shifting income from the higher to the lower earner on a couple’s tax return has somewhat diverted people’s attention away from the fact that CPP benefits can also be divided. Generally, if you’re 65 or older you can allocate up to 50 per cent of certain types of pension income to your spouse on their tax return. That includes payments from a workplace pension plan, a registered retirement income fund (RRIF) or a life income fund (LIF), among several others.

But couples cannot similarly divide up their CPP payments! Still, most online explanations of how pension income splitting works neglect to mention that Canadians can also share the CPP – by applying to Service Canada to do so.

The point of spreading CPP payments more equally is the same. If one spouse has much higher benefits, sharing can help trim the couple’s overall taxes. If both of you have been contributing to CPP or the Quebec Pension plan, sharing helps to distribute payments more equally. If only one of you contributed, you can share the one pension.

You must be living together to share the CPP. If both of you have been contributors, it’s not necessary to start receiving benefits at the same time. But to start sharing them, both of you must be receiving – or apply to start receiving – CPP income. Also, you can only split amounts that correspond to the years you have been together.

Where it Doesn’t Work

Where splitting your CPP could become a problem is if one person suddenly has a winfall of income. In those circumstances, the better-known, tax return-based pension income splitting offers more flexibility. For example, should the spouse in the lower tax bracket receive an inheritance and see their taxable income spike in a particular tax year after selling assets, such as a cottage, that can generate capital gains, a couple might simply avoid splitting their income on that particular tax return. This would likely be an isolated situation, but could offset a lot of the advantages in the other years by having to pay a significantly higher rate of tax on that split CPP pension.

While spouses can apply to cancel CPP sharing, the arrangement can’t be tweaked from year to year.

Still, for couples who don’t have many other sources of income that would be eligible for income splitting, sharing the CPP can be well worth it.

Consult the Pros

The best way to make sure you set this up properly and to avoid any accidental mistakes that could cost you bigtime is to hire a professional! Book an appointment today and we can help you out.

Disclaimer:

This article provides information of a general nature only. It is only current at the posting date. It is not updated and it may no longer be current. It does not provide legal or tax advice nor can it or should it be relied upon. All tax situations are specific to each individual. If you have specific tax questions you should book an appointment for a 1 on 1 consultation.