Tax Tip Thursday

MyCRA & MyBusiness Accounts

We are back to the MYCRA and MYBUSINESS accounts.

This one is dedicated to my office manager Mary! People not having these accounts causes her a ton of grief. We are having a lot of trouble with accessing people’s accounts already.

I am going to provide specific instructions attached to our show this week and people will be able to access it on our website. If you are becoming a client of ours, you can also call the office and we can also provide the instructions.

Why is this so important?

Personal Taxes

From a personal tax perspective, it allows us to download your tax slips at tax time. This is important because as you know, people lose their slips all the time. This will help us ensure that all of your income is accounted for.

It also allows either you or us to deal with the CRA if you are audited or reviewed. You/we can upload documents directly to them through your account.

If we do not have representation for you, we can NOT do anything with the CRA on your behalf. No phone calls, no uploading, nothing!

We can get access to your personal account much easier, but you STILL need to get access to your own MYCRA account.

Representing a Loved One

This is one of the bigger problems with the personal tax returns. When our parents or elderly family die, someone needs to deal with CRA. If you already have access as a representative of the individual, your life will be sooooooooooo much easier when comes to finalizing everything at the CRA. We have had people take months trying to sort out the access.

Please take a few minutes and become representatives of your parents or elderly family members!

Business Taxes

From a business perspective, it is a much bigger problem!

We literally CANNOT complete your books or taxes properly without access to your CRA accounts. Save for the odd client, all clients have balances at the CRA which need to go on your balance sheet. If we do not have access to your CRA account we cannot get the correct balances. This could include payments, penalties, interest and assessments.

The impact of your balance sheet not being correct is that amounts could get charged to your shareholder account in order to balance the books.

The impact of that is that it affects your personal income and the amount of tax you pay!

It is totally a ripple effect.

The other BIG problem is that we cannot file your HST on your behalf. This is the one that is becoming particularly problematic of late.

The CRA has mandated effective Jan 1, that you HAVE to file your HST online! YOU CAN NOT FILE HST WITH PAPER ANYMORE.

The reason that is a big problem is for businesses that have fallen behind in their business and/or personal taxes. If your taxes are not up to date, it is problematic to get access to your own account, meaning you cannot give us access either.

Short story – YOU HAVE TO HAVE ACCESS TO YOUR CRA BUSINESS ACCOUNT IN ORDER TO GET YOUR TAX PREPARATION COMPLETED.

How do I get access?

It is actually a straightforward process for the most part.

For initial access for yourself, you have to go to https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html

You have to provide basic tombstone information as well as information from one of your 2 previous years tax returns.

Once you have personal access then you can get Business Access.

All the details of each of the scenarios is below:

- How to get access to your own personal CRA account

- How to get access to your own Business CRA account

- How to provide us with access to your Business CRA account

- How to become a representative of your family member

Please make this happen for your own benefit!

Here are the instructions to get your own CRA account and to provide someone with representation on your behalf.

To start, click here to go to the CRA website and scroll down to My Business or My Account, whichever is applicable to you.

Step 1 — Provide Personal Information

- Enter your social insurance number.

- Enter your date of birth.

- Enter your current postal code.

- If you live outside Canada and the United States, the postal code or ZIP code is not required. The postal code or ZIP code field is not case-sensitive and may or may not include spaces or dashes.

- Enter an amount you entered on one of your income tax and benefit returns.

- Have a copy of your returns handy as you will be asked for a specific line’s amount and the line amount requested will vary; it could be from the current tax year or the previous one. A return for one of these two years must have been filed and assessed to register.

- Create a CRA user ID and password.

- Create your security questions and answers.

- Save or print the list of questions and answers!

- Enroll in mandatory multi-factor authentication by selecting your preferred method (telephone or passcode grid).

- Enter your business number. If you are applying for a personal account, omit this step.

Once you have completed the request, close the browser tab.

The CRA will send your security code via surface mail, and it will take 5 to 10 business days to arrive. This is one brown CRA envelope you should open immediately.

Step 2 — Enter the Security Code

Of course, you have to wait for the envelope to arrive in the mail.

- Go back to the CRA website and click on the green sign-in button.

- Now, choose My Business Account (if applicable), and go to “CRA sign in”.

- Sign in with the username and password you created in the steps above, and enter the code from the envelope when prompted.

Step 3 — Add The Mad Accountant as an Authorized Representative

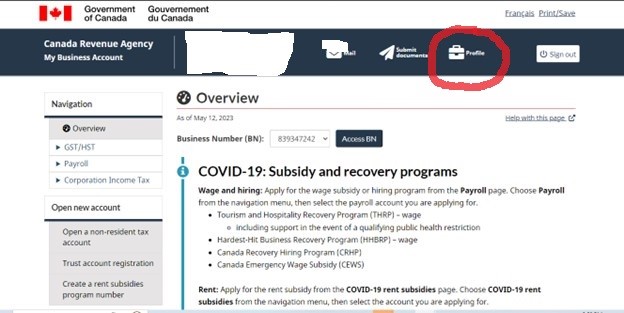

- Once you’re logged in, click the Profile button in the top right of the screen:

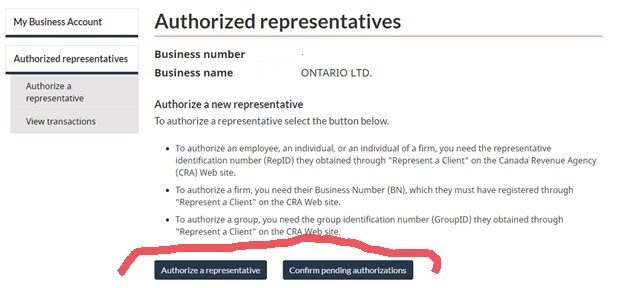

- Then, find the button for Authorized Representatives.

- From here, click the button to Authorize a representative:

Add The Mad Accountant with this information:

- The Mad Accountant Inc.

- Group Rep ID# GZG8MR

Go back to the list of authorized representatives and double check that it worked.

Let us know when this is done!

Once you’re done with this process, we will be able to access your account and do all our work. If you’re having trouble with any of this we are here to help! Book an appointment today.

Disclaimer:

This article provides information of a general nature only. It is only current at the posting date. It is not updated and it may no longer be current. It does not provide legal or tax advice nor can it or should it be relied upon. All tax situations are specific to each individual. If you have specific tax questions you should book an appointment for a 1 on 1 consultation.